On the First 50000 Next 20000. 1 Accounting Software in Malaysia We empower more than 600000 accounting and business professionals using SQL Account and SQL Payroll to perform their daily operation effectively.

Lhdn E Filing Your Way Through Tax Season Properly

Appointment Of Tax Agent By Taxpayer.

. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. In September 2021 the government. Please ensure you have submitted your e-Daftar application before submitting the supporting documents using the feedback form.

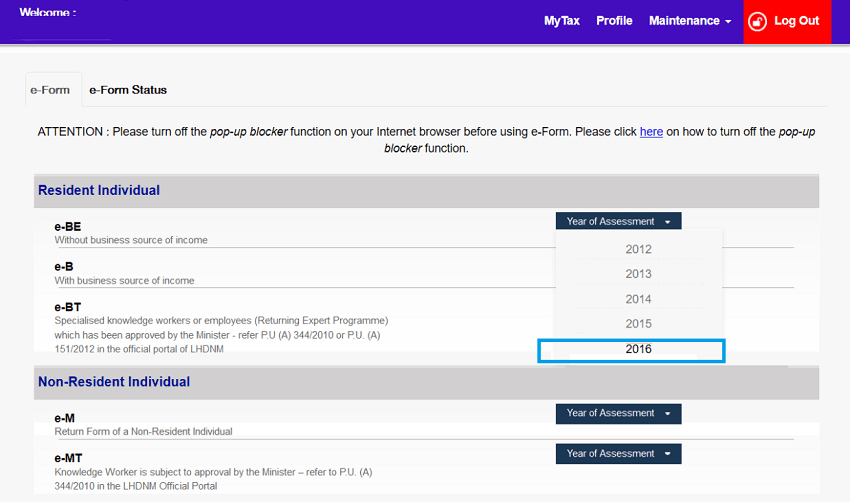

You can learn how to file your income tax in Malaysia using LHDN e-filing with our complete guide and get the latest list of official tax reliefs for YA2021. 30042022 15052022 for e-filing 5. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

Profession As A Tax Agent. Appointment Of Tax Agent By Taxpayer. Submission of e-Daftar supporting documents can also be made via our e-daftar.

Appointment Of Tax Agent By Taxpayer. E - Filing Tax Agent First Time Login Login Download CP55 CP55A. Appointment Of Tax Agent By Taxpayer.

Apply for a term life insurance on RinggitPlus for exclusive gifts. Select Accounts Banking then select Bill Payment. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU.

Profession As A Tax Agent. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. A recent tax case is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

A Complete Guide to Start A Business in Malaysia 2022. Everything You Need To Know About Term Life Insurance. List of income tax relief for LHDN e-Filing 2021 YA 2020 To make it easier for you to plan manage and file your income tax below is a list of tax reliefs for YA 2021 by category.

Appointment Of Tax Agent By Taxpayer. E - Janji Temu. The Best Accounting Software trusted by more than 250000 companies.

Appointment Of Tax Agent By Taxpayer. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. Profession As A Tax Agent.

Appointment Of Tax Agent By Taxpayer. Form B Income tax return for individual with business income income other than. Appointment Of Tax Agent By Taxpayer.

Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Profession As A Tax Agent.

Appointment Of Tax Agent By Taxpayer. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Form BE Income tax return for individual who only received employment income Deadline.

A number of other legal commercial mercantile or capital market instruments eg. 31032022 30042022 for e-filing 4. This implementation applies to riders which are not related to life insurance such as critical illness medical cards and.

Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

As announced by the Finance Ministry on 16 May 2018 Term Life Insurance will be zero-rated from 1st June onwards. 2B-LHDN-01 Aras 2 Pusat Transformasi Bandar UTC KOMTAR. A 175 has been introduced to restrict deductions for interest expenses or any other payments which are economically equivalent to interest to ensure that such expenses commensurate.

E-Filing Organization Download CP55B CP55C. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. A s s i s t a n c e e-Filing Handbook.

On the First 70000. 2014-10-17e - Filing Tax Agent First Time Login Login Download CP55 CP55A. Profession As A Tax Agent.

Special rental income tax exemption for YA 2021. 2022-3-7Check out last years tax rebates here. And A duplicate or a subsidiary or a collateral instrument when it can be shown that the original or principal or primary instrument has been duly stamped.

E - Janji Temu. E-Filing Organization Download CP55B CP55C. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology. Profession As A Tax Agent. Power or Letter of Attorney Articles of Association of a Company Promissory Notes Policy of Insurance etc.

A s s i s t a n c e e. To facilitate communication via our 1 300 88 3010 telephone service. Profession As A Tax Agent.

Profession As A Tax Agent. Profession As A Tax Agent. Real estate agent commissions.

E - Janji Temu. Profession As A Tax Agent. 2014-10-17e-Filing Prefill Data Login Prefill e-Data e-Filling.

2022-3-8Generally tax reliefs are portions of your income that do not need to be included in the calculation of your taxes. 2021-2-19Form used by company to declare employees status and their salary details to LHDN Deadline. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable.

E - Janji Temu. E-Daftar is an income tax file registration system for new tax payer to get their income tax file number. Appointment Of Tax Agent By Taxpayer.

Ranked at 24 th in 2018 World Banks Ease of Doing Business Malaysia is fast gaining traction as one of the favourite investment destinations to do business in Malaysia and building a business in Malaysia. How to make a LHDN payment. E-Lodgement CKHT e-Form Login.

E - P a y m e n t e-Payment via FPX. Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business in. E - Janji Temu.

Purchase of basic supporting equipment for disabled self spouse child or parent. Income Tax File Registration. What are the income tax rates for expatriates and non-residents.

2020-7-16Income tax filing for sole proprietors is straightforward. E - P a y m e n t e-Payment via FPX. E - Janji Temu.

Pdf Perceived Risk And The Adoption Of Tax E Filing

Simple Faq E Filing Lhdnm For Malaysian Working In Singapore Miniliew

How To File Your Personal Income Tax A Step By Step Guide

Form B Yau Co Accounting Tax Company Registration Facebook

Pin St Partners Plt Chartered Accountants Malaysia Facebook

Lhdn Extends E Filing Deadline To June 2020 Also Applies To Manual Submission Lowyat Net

Lhdn Extends E Filing Deadline To June 2020 Also Applies To Manual Submission Lowyat Net

How To Apply Pin No During Mco Yau Co

E Government Policy Ground Issues In E Filing System

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Iproperty Com My

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

Storyboard On User Centered Information Architecture Proposal For Lhdn Download Scientific Diagram

Ctos Lhdn E Filing Guide For Clueless Employees

Bernama Lhdn Allows Deferment Of Small Value Withholding Tax Payment

3 How Do I Complete And E File The Corporate Income Tax Returns Form C S C Youtube

Ctos Lhdn E Filing Guide For Clueless Employees

Never Filed Income Tax Before Here S A Simple Guide On How To Do It Online World